Cost Segregation from the Basics

Cost segregation is a method of accounting that allows you or your LLC to depreciate your fixed assets much faster than using the standard 39 year or 27.5 year straight line accounting methods. Cost Segregation Enterprises will identify these qualifying fixed assets that can be legally removed from the 39 year category and then will be placed in the five year, seven year, or 15 year categories.

Cost Segregation Follows Schedules

For example, every asset has a tax category of five, seven, 15, 27.5, or 39 year period, depending on its use or location. An auto dealership or dentist building is in the commercial building category, which means it follows the 39 year method of accounting, whereas apartments or rental housing falls into the 27.5 year accounting method. But in real life, these two types of commercial facilities aren’t one big asset, respectively; they are composed of many, smaller assets. For instance, she carpet value has a five or seven year depreciation, whereas the exterior framing has a 15, 27.5, o 39 year depreciation. It all depends upon function, process, attachment or domestic requirements.

Cost Segregation to the Rescue

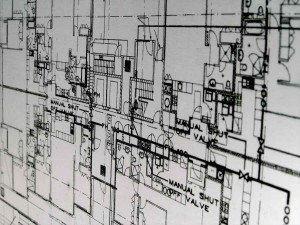

This is where Cost Segregation Enterprises comes in. A cost segregation allocation is performed by a qualified construction estimator to distinguish (or segregate) a commercial property’s assets. Those assets are then reallocated to their shorter categories, which means a much larger “pool” of depreciation for your use. The possible tax savings can be enormous, resulting in a potentially substantial influx in cash flow.

In Summary

We simply turn your blueprints into potential cash in your pocket. If you’re a CPA, and your client currently owns or recently has constructed, rehabilitated, acquired a commercial building, contact us. We are ready and willing to help you in turn help them realize substantial tax savings and increased cash flow. Call or email today.

*Remember, we only help your depreciation schedule; we don’t complete tax returns.